NZME asked the commerce commission for urgent approval to buy Stuff for $1. Minutes later, Stuff’s owner said it was no longer in talks with NZME.

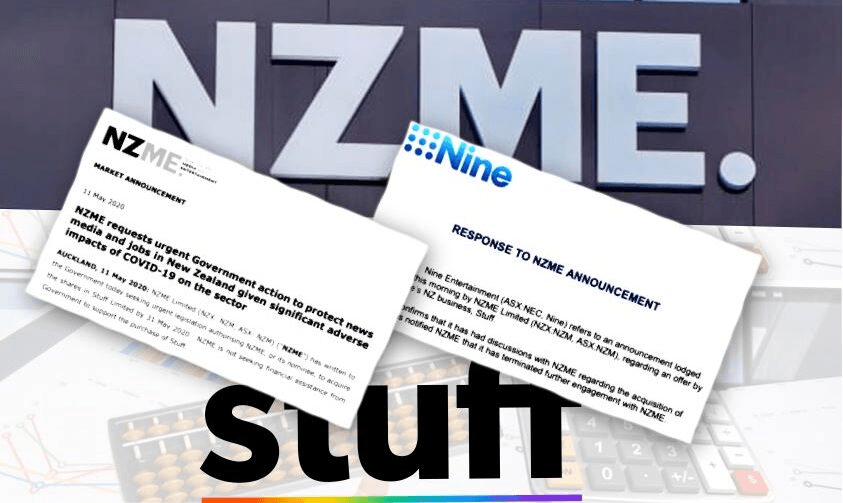

In the space of a chaotic few hours, the long-running courtship between print media giants NZME and Stuff dramatically escalated, as NZME informed the sharemarket that it was seeking urgent government permission to buy its rival. A hour later Stuff published a story in response, in which its owner, Australian media conglomerate Nine, said that talks between the two had broken off last week.

It didn’t stop there, with NZME posting a follow-up announcement just after noon, asserting that it remained”in a binding exclusive negotiation period with Nine” and “does not accept that exclusivity has been validly terminated”.

The episode began through a story on the NZ Herald site, one of a large number of media properties owned by NZME, which stated that it had filed an urgent application with the Commerce Commission to be given permission to buy its rival. It cited a price of $1, which would exclude certain non-media assets, but include all its liabilities, and a date of settlement of May 31.

The story was published at 9.34am. When the NZX opened at 10am, NZME shares jumped nearly 5% in early trading. Just over an hour later, Stuff published a story emphatically rejecting the idea that any such deal had been struck. In fact, a spokesperson for Nine said that talks had broken off last week, and that a statement would be forthcoming.

As well as through their media properties, the spat played out in announcements to the share markets in Australia and New Zealand.

These are the last twists in a saga which has run for five years, with permission twice denied by the Commerce Commission, and an unsuccessful case at the Court of Appeal in 2018. Late last year NZME once again raised the spectre of a merger, after Stuff was unsuccessfully put up for sale by its owner Nine early in 2019.

NZME, which owns a large number of radio stations in addition to its print assets, revealed in its market announcement to the NZX that it entered an exclusive negotiation period with Stuff’s owner, Australian-based Nine Network, on April 23. A letter signed by CEO Michael Boggs and chair Peter Cullinane laid out the case for the merger to be allowed to go ahead despite the ComCom’s resistance.

“NZME believes that the New Zealand media sector is too small for the current number of quality participants and consolidation is urgent in the face of dramatically declining advertising revenue and current general economic conditions,” they wrote.

“The significant obstacle we face is that there is insufficient time to do so given the extraordinary conditions the industry finds itself in. We are mindful of what happened to Bauer Media and we are focused on saving hundreds of jobs and regional mastheads which may be lost if we do not act with this urgency. Time is of the essence and we seek your urgent assistance to allow completion by 31 May 2020.”

The situation comes with no small amount of urgency, as the fallout from Covid-19 and the lockdown has seen print advertising revenues, the lifeblood of both newspaper chains, fall away drastically. This led to a $50m government “triage” package of support for media in late April which significantly weighted its support towards broadcasters like MediaWorks and the state-owned TVNZ.

While most industry CEOs believe some form of consolidation is inevitable, there remains significant disquiet about the prospect of a merged NZME and Stuff, given that the duo represent around 90% of all online news traffic in New Zealand. Allied Press, publisher of the Otago Daily Times and the third-largest publisher in New Zealand, has publicly stated its opposition to the move. NBR publisher Todd Scott has persistently talked about his desire to purchase Stuff, saying he has private equity backing for such a move. However sources at Stuff say Nine has refused to engage with Scott on the matter.

Stuff’s situation is precarious, because Nine has already signalled it does not want to own the New Zealand business, and its own revenues have also been significantly impacted through its print, digital and television assets in Australia. There are fears within the industry that should Nine see Stuff as a loss-making operation for the foreseeable future, as the economy enters its greatest downturn since the great depression, it might not be willing to put cash into Stuff to fund its operations. That is the kind of disorderly event which saw Bauer NZ collapse in early April, leading to the loss of nearly 250 jobs.

With Stuff being New Zealand’s largest employer of journalists, and its chief news source from Hamilton to Christchurch, there is a desire from all parties not to see it collapse. The question is whether NZME is the best available operator, or whether another acquirer – possibly the government through TVNZ – might appear to try and prevent such a major consolidation within a single medium.