New Zealand’s new unofficial flag isn’t Laser Kiwi, it’s the increasingly ingenious way our retailers give us the news that hurts – no Paywave. Rebecca Stevenson investigates the unrelenting demand for tap and go payments.

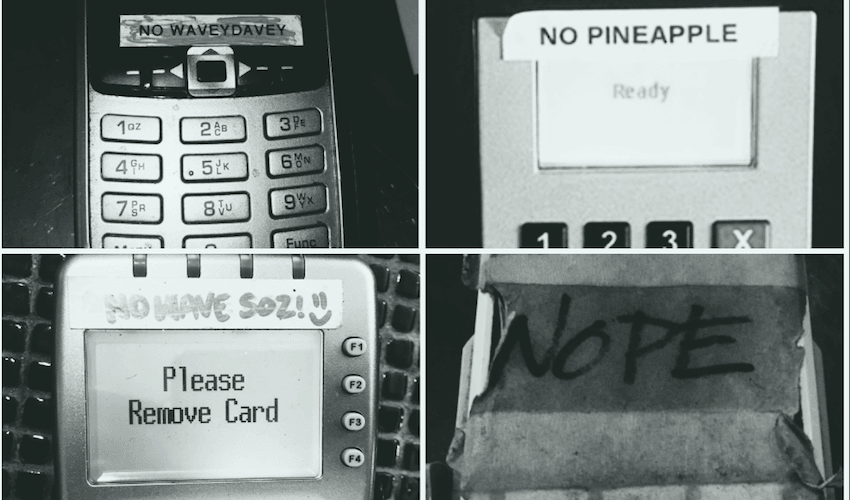

I’m sure you’ve seen them – sometimes it’s an old bit of brown tape with “NO PAYWAVE” in biro. Some retailers whip out the label gun and make something a little more formal. Then there are the retailers who take the chance to have some fun: “no wavey davey” (my personal fave), “no pineapple” (huh?), or just the short and sweet “NOPE”.

So what’s the deal? Why do so many small businesses not offer Paywave? I’m sure it wouldn’t surprise you to learn that it’s about cost. But to understand why so many smaller retailers can’t stand Paywave or Paypass (Visa and Mastercard’s contactless debit cards), we also need to understand eftpos (electronic funds transfer at point of sale).

It’s almost part of New Zealand folklore at this point: back in 1984 eftpos first launched in New Zealand, with a bank computer connecting to a Woolworths and a Shell Service Station. Eftpos became a serious deal a few years later in 1989, when our four banks of the day decided to join together to build a Megatron of electronic payments – Electronic Transaction Services Limited (now Paymark) – to handle the country’s eftpos needs.

This one system to rule them all has worked out pretty well for consumers and retailers. Retailers pay a flat rate fee per month for eftpos transactions (around $15 per month per eftpos terminal), meaning there’s no significant cost to the merchant (or the customer) to use an eftpos card in-store. The one system has also meant your eftpos card is accepted all over the country, and in almost all retailers nowadays, despite there being different brands and types of eftpos machines around.

We’ve happily chugged along, patting ourselves on the back for being early adopters of electronic payments, and generally feeling smug after an overseas trip about how we couldn’t use our eftpos cards because all the systems are SO outdated!

But our no-cost-to-consumers eftpos system is under threat from an old foe. Consumers’ changing payment habits are leading the charge to contactless debit cards, but they are being aided and abetted by those who benefit; the banks and credit card companies who offer them.

Why do banks like Visa’s Paywave or Mastercard’s Paypass? Whereas banks don’t earn anything from Paymark’s eftpos transactions, contactless debit cards have average fees of about 2% of every transaction – which gets paid by the merchants and divvied up between the banks and the debit card providers (the fees to the card issuing bank are called interchange fees). These charges in New Zealand aren’t regulated, or capped, like they are in many other countries.

In 2009 the level of the fees became a bit of a worry, leading to the Commerce Commission investigating and settling with banks over merchant credit card fees with the aim of reducing them (and indeed a later report estimated about $70m was saved in merchants fees between 2010 and 2013). It also removed the “no surcharge rule”, meaning retailers could pass on credit card fees.

Now the fees have become a cause for concern again. A review into the competitiveness of our retail payments industry (started by former commerce and consumer affairs minister Jacqui Dean) found fees to merchants (that’s retailers) totalled an estimated $461 million in 2016. That’s not chump change.

In response, banks and credit card companies say they need that money to do things like fraud prevention and detection, security features, and so on. New Zealand Bankers’ Association chief executive Karen Scott-Howman says they can cover the costs of switching the transaction, detecting and preventing fraud, AND provide benefits to customers, such as rewards schemes and travel insurance.

Rewards schemes and travel insurance? Hmm. This stings, because we are also told merchants pass on the cost of card transaction fees by hiking prices of goods across the board; in essence funneling money from all of us (whether we shop with cash or cheque or whatever) to a bank’s credit card customers through generous rewards and cashback schemes.

Banks have a lot of influence over how we spend our money; contactless card critics point out a lack of innovation in bank cards is leaving the eftpos network vulnerable and pushing consumers towards the credit card networks. And recently Paymark – formerly owned by the banks – was sold.

Consumers, too, are driving this move because of self-interest; these days everyone wants to pretend they just don’t have the time to swipe – or, even slower, insert an eftpos card – and then put in a pin, when contactless debit cards have you pulling that most glorious manoeuvre: tap to pay.

It’s also helpful when you are holding a kid and just want to escape a shop asap, and it speeds up your drinks order at the bar. Boy, we do like to tap that. In 2017 New Zealanders made more than 1.6 billion debit and credit card transactions through point of sale systems with a value of $82.6b, industry body Payments NZ reported. We each made (on average) about 123 credit card transactions (which include contactless debit cards) per year, well up on the 103 or 83 each of us made (again on average) for the prior two years. In contrast, but still mind-blowing, Kiwis wrote 23.1 million cheques in 2017.

On average we made 214 debit card transactions each in 2017 (down from 232 and 234 in the previous two years). There is a lot of dosh still flowing through eftpos, with Paymark capturing $1.4b of card transactions worth $62b, but there is no doubt contactless debit transactions are on the rise.

What could possibly be bad about this, you cry! I love to tap, tap tap! (And the response on Twitter when I asked about it was strongly in favour – we love to tap and go). But there are some drawbacks. Of course, there are the merchant fees discussed above, and the additional costs lumped on to all of us. Consumer NZ says “the use of these cards generates revenue for banks and schemes but increases the cost of doing business for merchants and results in higher prices”.

How much does this cost us? Retail NZ (the advocacy group for retailers) says a 2015 report found the hidden cost of payment systems to shoppers is currently approximately $380m per annum and is forecast to rise to as high as $711m by 2025 – an estimated total cost of $3.1b over the next 10 years. It says Kiwis already pay higher credit card fees than in other comparable countries, and there’s no telling how high fees may go. A 2013 report from the Commerce Commission found interchange fees may be rising again but didn’t think its intervention would be needed, instead pointing to “alternative regulatory intervention”.

The Bankers Association disputes these estimates, and says in fact retailers who accept “scheme card transactions benefit from increased transaction volumes, reduced cash handling costs, and reduced fraud from other payment methods like cheques and cash”.

“Whether or not retailers choose to pass those costs on to consumers is up to them. It’s inaccurate to say that all retailers raise their prices to cover those costs. Some may do so, while others may absorb it as a cost of doing business,” chief executive Karen Scott-Howman says. And she says in countries where merchant service fees have been regulated, the evidence shows reductions haven’t been passed on to consumers.

There are some purely practical issues with tap and go too. There’s the weird discomfort that comes from accidentally paying with your contactless card when you planned to pay cash; or the weird time/disconnect between making a payment and it actually happening (many users reported withdrawal delays with contactless cards). A big concern about the rise of these cards is that they are taking out eftpos and a low-cost option. Consumer advocates fret that once eftpos is gone (and no regulations govern card fees) the fees could be made higher and higher.

In its favour is of course the effortlessness of tapping, and overseas (unshackled from a low-cost eftpos network) contactless cards are being introduced in really handy ways, like to pay for public transport. Mastercard’s New Zealand manager Ruth Riviere says tourists (and therefore business) would benefit from the introduction of contactless card payments for transport. “I can see even more money coming into the economy,” she says. Riviere says businesses around transport hubs do better with contactless payments enabled and it’s better for tourists too in terms of safety and security – there’s no need to carry cash.

Not all retailers are against contactless cards either. The same thing that makes contactless cards so beloved by customers also makes them appeal to merchants: time. National fuel chain Z Energy says it was the first national chain to roll out contactless payments at all of its more than 200 Z branded retail sites back in 2013.

Spokeswoman Georgina Ball says the speed of contactless payments has resulted in fewer periods in-store when two tills need to be open. She says it’s now at the point where customers expect to have contactless as an option, with contactless making up more than 60% of Z’s Visa and Mastercard transactions (and more and more customers are using their mobile phones to pay).

The company estimates using contactless removes around 10 seconds from each transaction’s processing time. “This may not sound a lot but it means one minute less waiting time for the 6th customer in the queue and two minutes less for the 12th person… And contactless is particularly speedy at Z because customers are generally spending less than $80 and this means they don’t get held up entering pins.”

But for smaller retailers, the benefits are less clear. They don’t have big bulky transaction numbers to negotiate lower transaction fees from card issuers, and consumers are getting ratty with them if they don’t have it (just search ‘no paywave’ on Twitter to test the temperature of those who really want to tap and can’t). Help may be on its way. Former minister Jacqui Dean wrote to Payments NZ asking them to report back by April this year on how they’re going to make our payments system more open and hopefully less costly. She also (surprisingly for a hands-off National party minister) warned regulation of fees may be coming.

Regulation seems the obvious answer, of course. Visa and Mastercard and the banks are not in favour – but there may be other options too. Now that Paymark is free from the banks there is hope they may invest in new technology, and Xero boss Rod Drury says the answer could be for banks to introduce their own contactless cards (though he’s also promoting intervention on fees).

As for us consumers, it’s likely we’ll keep a-tapping via Visa and Mastercard so long as our eftpos cards won’t give us the freedom we so dearly (and clearly) love. But don’t kid yourself – we always pay, one way or another. With eftpos, it’s likely that we won’t miss what we have until it’s gone.

The Spinoff’s business content is brought to you by our friends at Kiwibank. Kiwibank backs small to medium businesses, social enterprises and Kiwis who innovate to make good things happen.

Check out how Kiwibank can help your business take the next step.