One of the country’s highest paid chief executives has lost his job after an embarrassing brouhaha over personal expenses. Business editor Maria Slade tries to make sense of the mess.

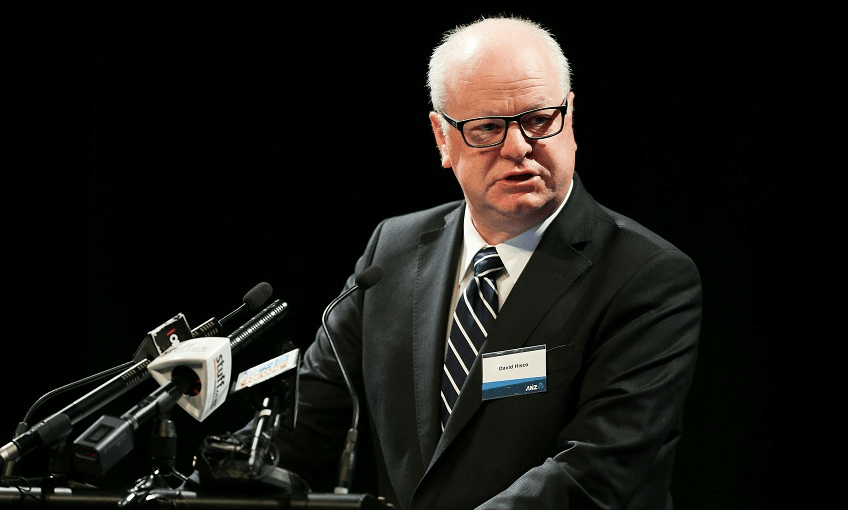

Who is David Hisco?

David Hisco was the CEO of ANZ New Zealand from 2010 until Monday. He started out working for a local branch of the ANZ in Australia and rose through the ranks. A significant point in his career was overseeing the merging of the National Bank brand into ANZ. Last year he earned a salary of $2.8 million including fixed pay and bonuses, and was one of the highest paid CEOs in New Zealand.

Why has he lost his job?

After an internal review ordered by ANZ group chief executive Shayne Elliott, concerns were raised about Hisco’s long term personal use of corporate chauffeured cars in New Zealand and storage of wine in Australia. The expenses go back over the nine years he was in the job and amount to tens of thousands of dollars, bank chairman John Key says.

Hisco thought he was entitled to the expenses, Key says. “If he had authority, it was oral in nature, so it’s difficult to establish one way or another.

“What is at the heart of this matter is the way this expenditure was recognised in our books. He was aware it wasn’t in the form it actually took place. It looked like it was a business expense, whereas it was a personal expense.”

The expenditure hadn’t been picked up earlier because it involved charge-back invoices, not credit card spending, the bank says. Hisco doesn’t accept all the concerns, but does accept accountability and agrees the “characterisation of the expenses falls short of the standards required”, the board says.

Does he have to pay the money back?

No. Key says the expenses in question were either “mischaracterised or there was a lack of transparency”, and ANZ won’t be seeking reimbursement from Hisco.

Does he suffer any other penalty?

John Key say Hisco’s departure is “a mutual parting of company”. He is forfeiting $6.4m worth of shares he would have otherwise been entitled to, but he leaves with a full year’s salary and any leave entitlements he’s accrued.

Wasn’t he already on leave?

Yes. Hisco went on leave in early May. On May 30 the bank announced he was taking extended sick leave and head of retail and business banking Antonia Watson would be temporarily filling in. As of today Watson has been appointed acting CEO. In its formal statement to the stock exchange ANZ says Hisco’s departure “follows ongoing health issues as well as Board concerns about the characterisation of certain transactions following an internal review of personal expenses”.

Has this got anything to do with ANZ being stripped of the ability to manage its own capital reserves?

Last month the Reserve Bank placed ANZ New Zealand on the banking naughty step for potentially lending to New Zealanders without enough capital to protect deposits. It revoked ANZ’s accreditation to model its own operational risk capital requirement due to a “persistent failure” to properly calculate risk, and ordered it to increase the capital it holds as a safety net.

John Key says these are “very separate issues”, and blamed the capital requirement breach on an error by a junior staffer. But the timing of Hisco’s departure just a month later is curious.

How big a deal is this?

It’s a very big deal. Acting CEO Antonia Watson says it’s been a “day of shock and disappointment”. The bank says it holds its staff to account no matter whether they’re a junior teller or the chief executive, and it’s been open with the banking regulators and the public about this. Hisco “has not met the standards and expectations of the organisation”, she says.

It’s also a bad look for a sector which is already feeling the heat. The Reserve Bank is proposing increasing the amount of capital all the banks must hold, a move the industry argues is over-cautious and will cost shareholders billions. Meanwhile former BNZ chairman Kerry McDonald has called for a commission of inquiry into our banks, similar to Australia’s Royal Commission which exposed widespread wrongdoing.

Does today’s announcement answer all the questions?

Hisco’s departure was apparently mutually agreed but you don’t relinquish a top role like that without good reason. He’s given up $6.4m worth of shares, after all. The bank’s explanations seem to raise many more questions. In the grand scheme of things, tens of thousands of dollars over nine years is not that much money and there appears to have been an element of misunderstanding – so why couldn’t ANZ have slapped Hisco over the hand and come to some agreement about repaying the money? Did he go on leave partly because of the expenses issue, or did it come to light when he went on leave? It would not be at all surprising if there were more revelations in the coming days.