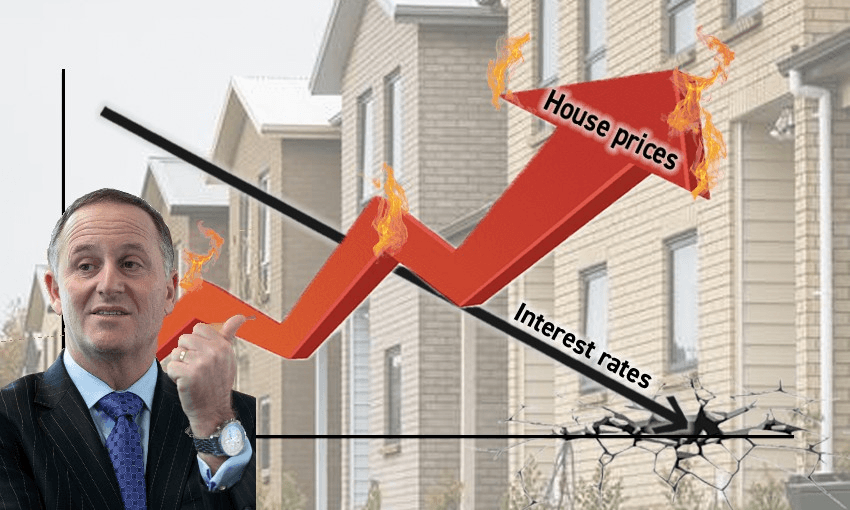

Super-low interest rates are a blessing to those already on the housing ladder. For those still renting and without a deposit, it is yet another nail in the long-sealed coffin of potential home ownership.

Last week, when Heartland Bank became the first lender in New Zealand history to offer a home loan interest rate below 2%, it carried all the trappings of good news.

Various media reports quoted industry reps celebrating the milestone: “Homeowners are reaping the huge benefits of low interest rates,” one said. Costs were being “passed onto borrowers”, said another. It ostensibly got even better when news broke that other banks were likely to follow suit and be lured into an ever-aggressive price war. After all, the RBNZ is expected to drop its Official Cash Rate (OCR) even lower than 0.25%, allowing banks to extend even cheaper credit to their customers.

To real estate agents and existing homeowners, it seemed like a golden age was dawning. With interest rates this low, there would be far more people going to auctions and making outrageous bids. There would also be less to pay on regular mortgage payments, freeing up money for more holidays, new cars or simply to pay off debt faster. Suddenly, in the middle of a recession, a large group of New Zealanders felt richer.

And while people feeling wealthier may be a welcome consequence of the RBNZ lowering the OCR, it has made an equally large group of New Zealanders feel poorer. For the many people who are still renting and haven’t yet saved a deposit, these super-low interest rates aren’t a good thing, and have only transmuted the prospect of home ownership, already a difficult goal, into an absurd fantasy.

Housing inequality

“Yeah, they’re really screwed,” says economist Shamubeel Eaqub of Sense Partners.

“Those people who have already saved a deposit, or have parents or family that can give them a deposit, are in a very good position because the cost of borrowing is so low. For the rest of the population, it sucks…”

The biggest reason why it’s so dire, Eaqub says, is while the cost of mortgages continues to decrease, housing costs for renters continue to rise.

“We’re in the middle of the biggest recession of our lifetimes, which is handled disproportionately by younger people. From that perspective, I guess the bigger issue is that rents are still rising – that means more of your income is being taken up by just your housing costs.”

With more first home buyers and investors lured into the housing market by low interest rates and affordable borrowing, the frenzy provokes bids for homes far above their capital value, further inflating already high house prices to ridiculous levels. The fierce competition is evident at auction houses and open homes, where even home buyers with good jobs and incomes are coming up against others prepared to pay a lot more. Prominent TVNZ reporter Kristin Hall recently tweeted that while house hunting, she was outbid by a man who said upon winning: “I don’t need any more houses, I have plenty”.

And the data certainly backs up the anecdotes. According to Real Estate Institute of New Zealand (REINZ) data, New Zealand’s median house price almost doubled over the past decade, increasing from $350,000 to $685,000, and rose 14.7% in the past year alone. Recent activity is particularly severe in Auckland, where the number of homes selling for more than $2 million has tripled since May, according to BusinessDesk.

And yet because median incomes have increased by far less during the last decade, and more money is going towards the cost of living and gradually rising rents, it means the all-important deposit is becoming harder to scrape together.

This is essentially why low interest rates have such serious implications for inequality. Earlier this week, Newshub quoted inequality researcher and writer Max Rashbrooke, who said the recent housing activity was essentially a bad thing. “It widens the disparity between the housing ‘haves’ and ‘have nots’,” he said.

It’s also clearly very serious when former prime minister and ANZ chairman John Key – whose government denied house affordability was an issue – expresses concern about where the market is going. “And it is as asset prices go up [it makes it] tremendously difficult for them to save that deposit,” he told a panel of other banking executives. “It’s a difficult one, because on the one hand we want people to get on the property ladder… But I do think we’ve just got to be careful we are servicing the sector, not feeding a bubble.”

So if the consequences of this low-cost borrowing are obvious for all to see, surely it can’t be a good thing for interest rates to drop even further?

Eaqub says the tool is not doing what it’s supposed to do and the RBNZ needs to try something else.

“I think the Reserve Bank is failing at its job because it is essentially inflating an already very, very overvalued and very expensive housing market.

“They already have the tools to control how much money goes into housing and where that money goes. But they have chosen not to act by essentially opening the floodgates towards investors in particular.”

Alternative tools

So what exactly are these tools and why aren’t they being used?

One of them, Eaqub says, would be to reintroduce the loan-to-value (LVR) restrictions, which dictates how much a bank lends against mortgaged property compared to its value. While the RBNZ removed LVR restrictions for 12 months earlier this year, by reapplying them to investment properties, it could funnel the affordable credit to first home buyers only, taking the market off the boil and potentially slowing growth.

“[The RBNZ] has poured fuel onto the fire. So, it needs to bring back the tools that it has used in the past, things like the LVR restrictions on investment properties and things to make sure that we’re not further detaching house prices from incomes,” Eaqub says.

However, senior economist Brad Olsen of Infometrics says while demand tools like LVR restrictions are useful and have had limited success in the past, without properly addressing the supply of houses and increasing the stock, they can only be so effective.

“There’s a question of whether or not the Reserve Bank could bring back those LVRs. The Reserve Bank’s also talking and toying with the idea of debt-to-income ratios. It hasn’t deployed those before, but I believe it’s got the ability to if it wants to.

“But all you have to look at is where house prices are now to see that they haven’t had enough of an impact [in the past] to really move the dial. We tinker too much with demand and forget about supply.”

Building more houses is frequently touted as the ultimate solution to New Zealand’s housing crisis. However, unlike the OCR, it is not a quick lever to pull – it typically takes a long time to increase the housing stock, evidenced by the fact that New Zealand has been pursuing the solution for years with little progress. The failure of Kiwibuild is a prime example. One of the Labour Party’s flagship policies, it was officially embarked upon in 2017 with the lofty ambition of building 100,000 houses by 2028. Fewer than 600 have been built so far.

So with the obvious fact that the RBNZ’s tools are exacerbating the housing crisis and invariably funnelling more wealth to asset holders, the question arises: why is the RBNZ choosing to lower the OCR at all? Surely there are more effective ways to stimulate economic activity without pricing a whole generation out of home ownership?

This is precisely the question economist Andrew Coleman of the University of Otago has been asking. What it comes down to, he says, is pushing the right buttons that stimulate spending and business investment without stimulating asset exchange – the type of activity currently seen in the housing market.

While he too is dubious about the effectiveness of lower interest rates to stimulate business investment and get people purchasing more goods and services, he says the RBNZ may not have much of a choice when so many other countries around the world are lowering theirs.

“If it didn’t, it’s plausible that the exchange rate would appreciate significantly, and then that would have depreciative effects on the real economy as well; export returns would go down, for instance,” he says.

“So the actual choice set that the central bank has to have much higher interest rates is going to be limited by the interest rate prevailing overseas. And in fact, you will notice that in most of these cases New Zealand is a follower of the rest of the world and not a leader.”

Stimulating spending

However, Coleman says that five years ago, New Zealand had some of the highest real interest rates in the world, and it did not have such a disastrous effect on exports. In other words, the option to keep interest rates high or raise them is there, but it comes with theoretical consequences, which the RBNZ would be unwilling to risk. With that option off the table, Coleman says there are alternative tools beyond what the RBNZ can do that could have the desired stimulatory effect.

“One alternative, which has been discussed a little, and certainly in the context of negative real exchange rates, is whether there would be scope for a temporary reduction in GST.

He says a GST cut, initiated by the government, would be a relatively quick tool to prompt people to spend more, without directing vast streams of money to investors, asset holders and the inflated housing market. To mitigate the risk of businesses refusing to drop their prices in line with the GST cut, the government could issue each person a GST card, which would apply a discount to purchases.

While minister of finance Grant Robertson has said he’s not interested in touching GST, Coleman says it may become a viable option when it becomes evident the tried and true monetary tools are simply exacerbating the maladies of our already ailing economy.

“Let’s face it: unemployment hasn’t even started yet. It’s forecast that it’s going to go from 4% to 8% over the next year and a half. That’s a significant downturn.”

“We’re wanting to stimulate the economy and yet ultra low interest rates aren’t actually financing new activity, they’re financing asset exchange at ever higher prices, and that is problematic. Maybe a better alternative is to have a temporary reduction in the rate of GST.”

Of course, GST manipulation on its own is not going to reduce house prices; it’s only a potential tool to get people spending and businesses expanding. In any case, it’s clear there are no easy answers to the dilemma. Uncertainty and risk plagues every possible solution, prompting policymakers to opt for the comparatively orthodox tool that appears – at least on the surface – to be doing its job. However, based on the trends, we can all know one thing for certain in the short-term; interest rates will continue to drop, the auctions and open homes will continue to heave, and the once vivid dream of home ownership will, for so many, continue to fade.