‘Business is Boring’ is a weekly podcast series presented by The Spinoff in association with Callaghan Innovation. Host Simon Pound speaks with innovators and commentators focused on the future of New Zealand, with the interview available as both audio and a transcribed excerpt.

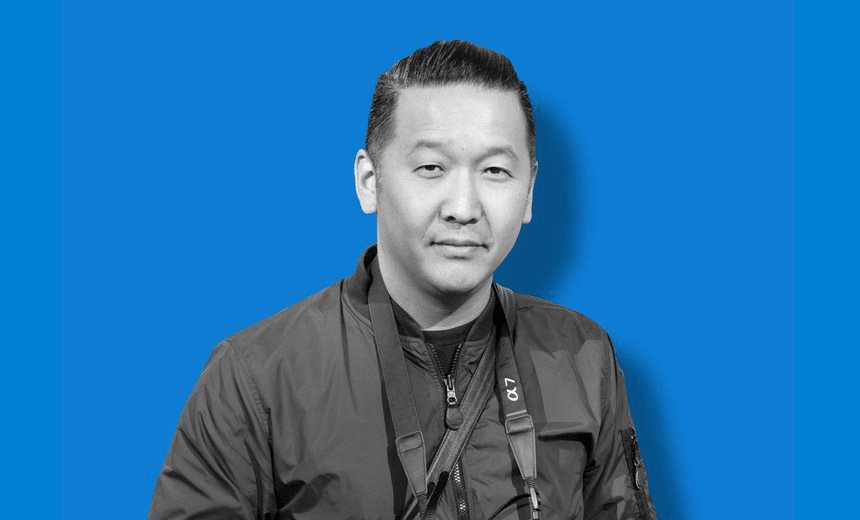

Stolen Rum, 42 Below, Sans, Triumph and Disaster. Some of the greatest brand led companies to come out of NZ, and all linked to the work of Kelvin Soh. Kelvin is a designer and creative director behind a range of companies and ideas that have found a voice on a world stage, and created huge value, in all senses. You’ll know his work, whether it is an award winning Broods album cover, or the exceptional cake mix boxes from The Caker, all gold and delicate and strong at once. Kelvin is one of our most awarded designers, but is known across many disciplines for his strategic approach to building brands and publishing his art/fashion magazines for the creative community.

He’s recently started a new venture with Stolen Rum founder Jamie Duff, called New New that is a vehicle to work with early stage and growth companies to help them replicate the kind of success they found with the Stolen Rum brand.

Either download (right click to save), have a listen below, subscribe through iTunes or read on for a transcribed excerpt.

Because that’s building very much on the journey you and Jamie took Stolen on isn’t it?

Yeah, I guess it’s probably general knowledge now that Stolen is now majority owned by a Chicago based company. To be honest, I think that a lot of what motivated that transaction, was so that we could scale it properly for the US market and to leverage their experience and knowledge in that sector. So with them running things, it really freed Jamie and myself up to look at other things. Even though I wasn’t necessarily full time on Stolen. So we thought, with New New, how can we bring our collective knowledge and experience from Stolen and the other brands I’ve worked on over the years, to other early stage companies who are interested in expanding, or interested in the New Zealand, Australia and US markets. Those are the markets we understand because those are the markets Stolen played in. We’re not necessarily limited to alcohol brands, though perhaps that’s the category we have the most knowledge and experience in. I work on skincare & beauty products as well, also FMCG products like Serious Popcorn and the mid-2000s on Charlie’s.

So we’re interested in a range of consumer lifestyle brands, basically. I think the in the case of New Zealand businesses, when it comes to scaling to go into these different markets, I feel like a lot of the brands weren’t really conceived for export when they were first set up. So we thought that we could help them to grow and pivot in the same we did with Stolen. People don’t really look at it too closely, but if you did you’d see that we pivoted when we expanded to Australia and again into the US. The pivots included changes to the brand story, which had to be adapted slightly for each market but also a lot of the operations type stuff. For example we had to retire the original bottle that people really loved and some people were really annoyed when we had to let it go. The truth is that it would have been impossible to scale that from a price point perspective. With all these things we’re really trying to evolve it in a manner that is still consistent with what the brands stands for. Taking people on a journey that is believable.

I am going to digress slightly by talking about this, but, the idea of believability is something that I talk a lot about with my clients. We’ve talked briefly about how I think brand perception is affected by its weakest link. This is especially important for premium brands. The analogy I sometimes use … I don’t know if it’s the best one … it’s a bit like if you’re watching a movie and then for a brief moment the actor breaks character, drops their guard and basically you end up, as a viewer, seeing the actor instead of the character. The ability of the actors to remain in character basically contribute to an overall believability as far as the story. Which enables you as the viewer to engage emotionally in what you’re seeing. The same applies to premium brands.

The reason we’re willing to pay thousands of dollars for a handbag by a luxury brand, is because we essentially believe in the value that is presented to us. That it somehow makes sense. Whereas if we imagine the opposite, say, a brand like The Warehouse, if they were to put out a range of premium products, we would be quite suspicious of their quality claims. Although we might think it’s a good deal if it’s still very cheap. That’s very consistent with the brand The Warehouse has set out to be. Premium brands take a loftier position by asking the consumer to pay a higher price for what they’re selling, and it’s like walking a tightrope. It’s a tougher ask to actually maintain the believable position. In New Zealand, the whole no. 8 fencing wire bravado that often gives birth to new businesses, could actually compromise that believability later on in the brand life cycle, because we feel like ‘yeah we’ll just do it ourselves’, instead of getting people who are really good at what they do to take it to the next level, and keep that believability going.

The best way to build that plausibility is really to build on the core brand truths. What is at the heart of a brand? Actually look at it with a clear-minded and sober viewpoint.