Welcome to the Cheat Sheet, a clickable, shareable, bite-sized FAQ on the news of the moment. Today we explain what Sky has done to its prices – and why they’ve done it.

What are they up to?

Sky has announced “new pricing and packaging” today, vastly simplifying the way people buy its product, and likely resulting in significant savings for existing customers – especially those who value sports.

And what exactly are these prices?

Sky Starter will provide an entry level way into Sky for $24.91 per month – slightly less than half the $49.91 price of Sky Basic currently, for a broadly similar service. This includes channels like MTV, Viceland, the all-important (for parents) Disney and Nick Jr, along with all your free-to-air faves. From there you can add the sports package for $29.90, which is incredible value given the amount of rights they hold. There’s also an entertainment package – the likes of UKTV, Discovery and CNN – for $25, which looks a tougher sell. And SoHo, their premium drama channel / HBO hoarder for $9.90. For the author, a typical Sky subscriber, this will result in a saving of around $50 a month, reducing my bill to around $65.

That’s still a lot more expensive than Netflix and Lightbox.

Yes, it is. But it’s a phenomenal amount of content, delivered using a mechanism a lot of New Zealanders – particularly older New Zealanders – know and love and don’t want to move on from.

Will it really move the needle for those ditching Sky – or the younger audiences who never have signed up?

Unlikely. It’s the best, boldest move they’ve made in some time, and for subscribers and would-be subscribers it goes a long way to pushing back against deep-rooted perceptions that Sky is the country’s biggest ripoff. Yet the quality of their digital product remains shockingly poor – glitchy, prone to denying access based on phantom logins, and with none of the native TV apps which make using Netflix and Lightbox so effortless.

The logical next move is to open up a true pureplay digital version of its product, offered at a cheaper price than its satellite service to reflect the absence of any physical infrastructure for the consumer. Arguably this move to rationalise pricing makes that one far easier to accomplish.

Why are they dropping their prices? Aren’t they still super profitable?

Well, yes. In fact, this announcement came alongside an interim report which revealed a 12% rise in its half-year results to December 2017 of $66.7m. It remains easily the biggest and most profitable media company in New Zealand, and this won’t change any time soon.

So a profit bump and some good new prices – assuming the share price ticked up?

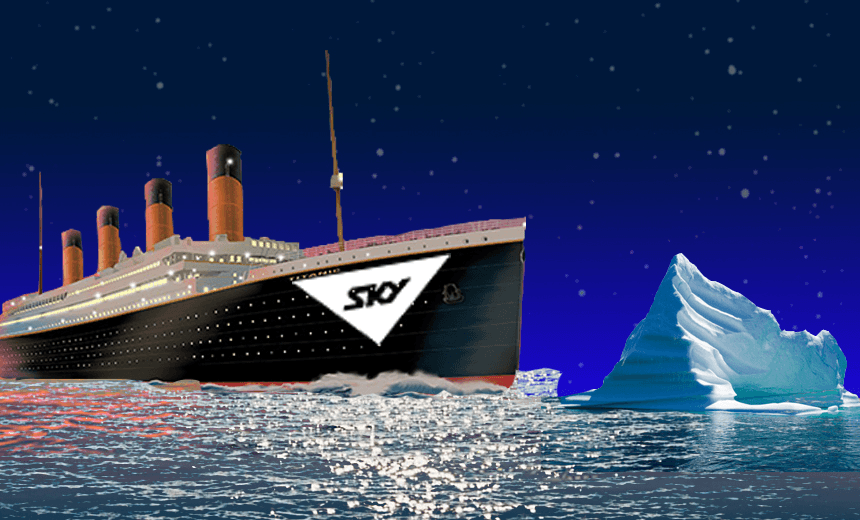

Quite the reverse. As we hit publish the shares are at $2.60, down 20c or a little over 7%. This is around half where they were in April of 2016. Put another way, during an historically great bull market run, Sky has gone from being worth around $2bn, to a hair over a $1bn.

Why is the market so pessimistic?

In a time of day, sunset. There is a sense that Sky’s years of being a big growth company paying strong dividends are over. That it has been overtaken by technology, consumer behaviour and international competition. More specifically, the market is likely looking at this announcement as likely to further eat into its profitability (by making its product cheaper) while not providing major upside to bring on new customers (because it remains stubbornly absent from a meaningful digital play).

So is it a good or a bad day for Sky?

Can’t it be both? The move on value is long overdue, and a major rationalisation of its often arcane pricing system. It should staunch the bleeding for those leaving because of cost, and might convince a few who left recently to return. The main thing it does allow is for a rearguard action to bring in a serious digital product, one which could be price-competitive with Netflix/Lightbox without cannibalising their own market. So if they do recover from this long slow decline, this might be remembered as the day it started.

At the same time – that share price is really, really low. Chief executives regularly fall for less. John Fellett is near-unique in New Zealand media, due the length of his tenure and his phenomenal record. But if the full-year result shows further attrition, Sky’s board might decide that he’s had long enough.

He seems to grasp, at least, the stakes. “We’re in a fight for our lives,” he said today.

This section is made possible by Simplicity, the online nonprofit KiwiSaver plan that only charges members what it costs, nothing more. Simplicity is New Zealand’s fastest growing KiwiSaver scheme, saving its 12,000 plus investors more than $3.8 million annually in fees. Simplicity donates 15% of management revenue to charity and has no investments in tobacco, nuclear weapons or landmines. It takes two minutes to join.