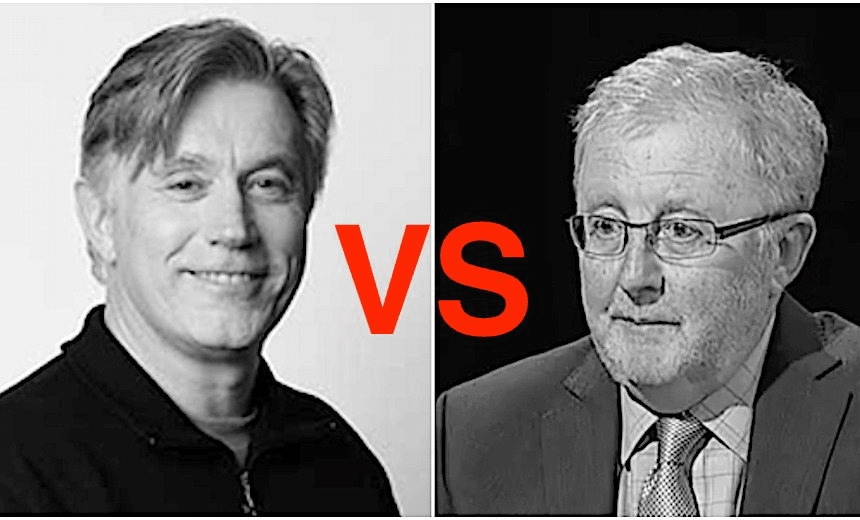

Over the past month, buried in the finance and markets pages of the Herald and elsewhere, there’s been a war brewing over KiwiSaver. The cause is the arrival and quick success of Simplicity, a not-for-profit Kiwisaver scheme. Simplicity’s Sam Stubbs responds to the latest, most aggressive attack from the sector.

Something strange is happening to the $30bn, fast-rising KiwiSaver industry created by Michael Cullen. A cosy little industry which was charging clients very large fees for comparatively little effort or gain, has been disrupted by funds like Simplicity, which replicate a highly successful offshore model, started by Vanguard over 40 years ago.

The incumbents are clearly not happy, and are lashing out. The most recent round was a column in the Weekend Herald.

A quick backgrounder. Passive investing seeks to match market returns by buying all companies that make up a market index like the New Zealand Stock Exchange Top 50 (NZX 50). The approach does not require swathes of highly-paid analysts, so is much lower cost. If the market goes up – as it has hugely for decades – then your funds go up.

Active managers, by contrast, seek to beat the index by analysing companies and picking winners. They charge a higher fee for the analysis, in some cases a much higher fee. In some areas, such as private equity, venture capital and hedge funds, there is some justification for the fees and salaries, but with listed investments it’s very questionable.

Passive investment, so successful overseas, has been thinly represented and marketed here, and the active managers aren’t happy with the changing environment. Recent commentary highlights their concern, as they see their complacent world under threat.

With a metaphor that smacks of desperation, Brian Gaynor, a longtime Herald columnist and asset manager with Milford (and someone I have greatly respected), on Saturday compared passive KiwiSaver fund managers to finance companies. Really? Finance companies were, at their worst, highly active, highly risky, highly concentrated lenders. They were as far from ‘passive’ as one can imagine.

It didn’t stop there. Another argument Gaynor made was that passive funds are “freeloaders”, coat-tailing on the efforts of the research of active managers. In fact, passive managers don’t freeload on the efforts of active managers – they ignore them. They invest in companies that have already proved themselves by getting in to indexes like the NZX50. It’s the companies themselves that make the great investment decisions, not the fund managers who decide to buy them.

And “freeloading” implies that active managers are hard done by and exploited by their passive competitors. Really? Let’s have a whip round to support their charity – ‘Active Fund Managers’ Queenstown Refuge’. The gold taps in their second ensuite need replacing.

Another assertion was that passive investing means less investment in New Zealand. No evidence was provided to back up this claim, and we seriously doubt that it exists. We certainly haven’t seen any. As a fact, Simplicity invests as much in New Zealand as our competitors do.

For a decade now KiwiSaver has been a peaceful and highly profitable refuge for fund managers. The arrival of Simplicity has generated a groundswell of grumbling from what had hitherto been a fairly placid place, with some enormous fees charged on very ordinary returns. The double threat of low fees, plus passive investment, has many an active fund manager pacing, and some roaring.

In the past decade investors have cottoned onto the fact that in the majority of cases they don’t get returns that justify the high management fees demanded by fund managers. As a result passive investing has become so popular that, over the last decade in the US, it now dominates new investment.

The chart below shows the amount of money being invested in active versus passive strategies in the US since 2007.

This trend isn’t just the domain of the US market. In the United Kingdom there is also a growing backlash against high fees, encouragingly led by the financial market regulator there. The UK’s Financial Conduct Authority recently issued a scathing report about lack of value provided by active managers and their high fees.

It is little surprise therefore, that Simplicity, a proponent of passive index funds, has been perceived as a threat to the status quo.

Data from sorted.org.nz shows that, since inception, the average KiwiSaver fund has returned 5.2%, with the average fee being 1.1%. That means, for a decade now, over 20% of everything made by the average KiwiSaver has been taken away in fees. By contrast, Sorted shows that Simplicity’s fees are 50-65% lower than the industry average.

This is a big threat to fund managers’ bonuses, as fees for KiwiSaver fund managers total over $1bn since the scheme’s inception in 2006 – and are growing to the point that they charged over $300m in the year to March 2016.

Most KiwiSaver investors have no idea they are paying these huge fees. That’s because most managers don’t want to tell them in a way they would understand.

This year the Herald exposed five large providers charging their members $160m in hidden, albeit legal, KiwiSaver fees. The FMA responded with proposals that KiwiSaver managers tell their members what their fees really are, in dollars and cents. But in a shameful example of putting KiwiSavers last, the Bankers’ Association are now lobbying to delay this change.

When setting up Simplicity, we could have chosen any investment strategy to make our members richer, including active investment. But as a nonprofit, returns to members, after fees, were all that mattered.

After much research, we chose to invest passively. The evidence is clear and unambiguous.

American financial services company Standard and Poors tracks the performance of all of the world’s active fund managers in key markets. Sadly New Zealand is too small to be included – but Australia is surveyed.

To summarise the key findings:

- In Australia, over the last five years, active share market funds failed to beat the index 69% of the time. 88% of fixed interest funds failed this too.

- In Europe, over 10 years, active fund managers have failed to beat the index 74-98% of the time, depending on the asset class they are managing.

- In the US, over 10 years they failed 67-95% of the time, depending on asset class.

These are the reports that active managers never want you see, but they’re publicly available here.

Ironically, the most successful active investor ever, Warren Buffett, supports passive investing for most investors. His money is going into a passive fund when he dies. It’s what the Cullen Fund does with the majority of its money too.

The other claim against passive investing in New Zealand is that our market is somehow different because we are small, inefficient economy with plenty of chances for active managers to beat the index. That argument has some merit, and a few managers have done well – including Gaynor, with his Active Growth fund at Milford Asset Management.

But no reliable long term data exists, because managers here often choose ‘soft’ benchmarks they can easily beat, and many invest in Australia too, which muddles the data for New Zealand investing.

What data we have shows Australia is a market where they are likely to underperform.

And the problem for KiwiSavers is that – even if it’s true that some active managers beat the New Zealand sharemarket – the NZX is usually a minority of investments in their KiwiSaver fund.

Gaynor’s recent Herald article also claimed that small companies would be starved of investment because passive managers would ignore them. Actually, the opposite will happen. For too long most ‘active’ investing has been, effectively, dressed-up passive investing. It’s called ‘index hugging’, and small companies, who aren’t in the indexes, tend to suffer. Banks are loathe to lend money to smaller companies, let alone invest in them via their KiwiSaver funds.

The happy reality is that passive investing will inevitably change the New Zealand market, as it has done the in the US and Europe – and small companies will be the biggest winners.

Overseas, lowest fee managers like Vanguard have forced active managers to justify their fees by investing in smaller, higher growth companies. In the US alone, $2 trillion is waiting to be invested in high growth companies by active managers, who need to find better returns for the fees they charge. The same will happen here.

No matter what the active managers say, and what they might do in any given year, over the long run the numbers don’t lie. Fees are the most important factor for maximising returns to investors. It’s because it’s such bad news for bank profits, and fund manager bonuses, that we hear the old guard roaring.

Let the battle commence. Investors will be the winners.

Disclosure: the author Sam Stubbs is MD of Simplicity, a not-for-profit KiwiSaver provider focussed on passive funds.