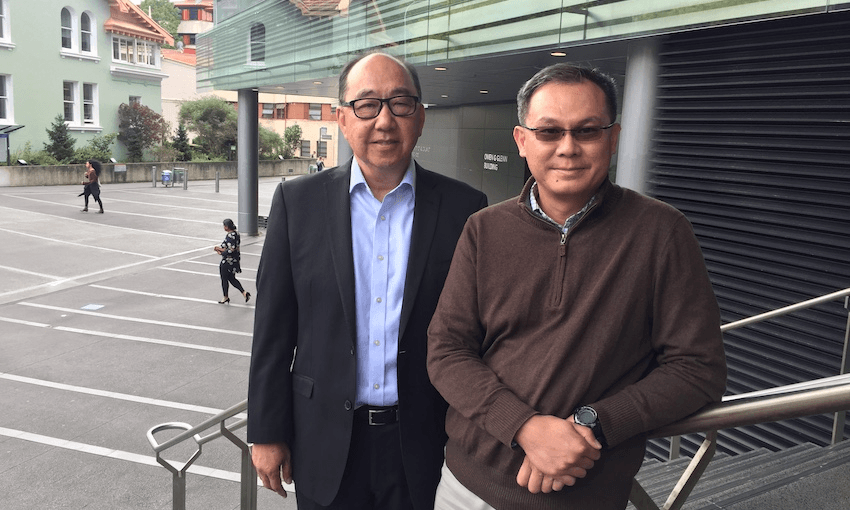

Tax Heroes: We always hear about who is not paying tax, but who pays the most hasn’t been measured – until now. Maria Slade talks to the two Auckland professors behind the numbers of Tax Heroes.

In the days of former prime minister Rob Muldoon you couldn’t get a first class flight out of the country for love nor money, because business people finding any spurious reason to travel had booked them out.

First class tickets were categorised as ‘export market development expenditure’, Auckland University accounting professor Jilnaught Wong says, so for every dollar companies spent they could claim $1.50 back. He remembers writing about it in his PhD thesis. “You’d pay, what, $10,000 for a first class seat, and you could deduct $15,000 as expenditure. And, if that resulted in a tax loss, you got a cash tax refund.”

While corporates claimed ridiculous refunds, top individual earners were being taxed at 66 cents in the dollar. The highly interventionist policies of Muldoonism penalised people for working hard and encouraged some to avoid tax by investing in schemes in the kiwifruit and forestry industries set up for the purpose, Wong says.

Three decades later our tax system is much fairer and more evolved, he says. He and his Auckland University colleague Professor Norman Wong were heartened when their research into our biggest publicly listed companies found that they largely pay the 28% statutory corporate tax rate. “That was a nice surprise,” Jilnaught Wong says. “The tax laws have become pretty tight, they’ve closed up a lot of loopholes.”

The Spinoff’s Tax Heroes project prompted the two professors to do the study. It was timely, they say. There is very little academic research in the area, and headlines about mega-multinationals such as Apple and Google allegedly not paying their dues have made tax a hot topic.

On this point Jilnaught Wong argues the tech giants have been much maligned. Apple sells a lot of iPhones to Kiwis but it’s not based here, so why should it pay New Zealand income tax? However, a New Zealand company that on-sells those iPhones pays tax on the profits from the sales. “No-one criticises overseas suppliers of The Warehouse who probably sell it $1 billion worth of goods every year and don’t pay New Zealand tax either,” he says.

While The Spinoff simply wanted to create a list of who pays the most tax in New Zealand, Wong and Wong took the matter several steps further and delved into whether our businesses routinely avoid tax.

It was reassuring to find that Kiwi corporates appear to be meeting their obligations, they say. The pair examined the accounts of companies listed on the NZX 50 for the three years from 2015 to 2017, and found on average they paid a cash effective tax rate of 22.7% – that is, the amount of money paid to the Inland Revenue Department as a percentage of their pre-tax accounting income.

The commercial property and retirement village companies skew the numbers. Their property assets generally go up in value over time and those value increments are recognised as pre-tax income, but because New Zealand does not have a capital gains tax these increases are exempt – and their effective tax rate appears lower.

If the property firms and aged care operators are taken out of the sample, the NZX 50 companies paid an average 27.8% in tax between 2015 and 2017, Wong and Wong say.

It was important to look at the results over a period of time to get a clear picture, as companies’ tax payments fluctuate from year to year, the academics say. They point out that it took Inland Revenue until 2010 to disallow deductions the energy company Trustpower had claimed for $17.7 million worth of development expenses between 2006 and 2008. It was another six years, and several court cases, before it was finally concluded that the costs weren’t deductible.

The Auckland University academics have got the bit between their teeth now, and ideally they’d like to do an extended study to assess whether New Zealand companies pay their way. The current research doesn’t pick up situations where the law is unclear and the company has taken a liberal interpretation (as happened in the Trustpower case).

Analysis over time would throw up red flags, they say, but would be a big job. The data for the current paper had to be hand-collected, and the work involved examining 141 sets of accounts. “I’ve suggested another study over 25 years,” ponders Jilnaught Wong, “but whether we could get the data going back that far…”.

This content is brought to you by IRD. Ready for a cash flow game-changer? Only pay provisional tax when you’re making a profit. AIM, a new option with MYOB, Xero and APS.