Madeleine Chapman reflects on the week that was.

When I was 21 years old, I travelled to America and spent some time with my cousin in Albuquerque. She was 30 and had what I assumed was a reasonably high-paying job in healthcare. Even so, she lived a life of luxury that was a shock to me. She owned a lovely home, planned frequent weekends to Vegas, was happy to drop everything on a dime and roadtrip the west coast with me, and drove a very cool red Mercedes SUV. How?

Having grown up in New Zealand, I assumed she must have bought property somehow (she hadn’t). Or I figured she was earning millions as a salary (also untrue). When I finally tentatively asked about her financial situation, she casually explained her investment portfolio, both through government schemes and private investing. She explained how big her portfolio was and her dividends and her goals for the next 10 years. I nodded and felt deeply frightened.

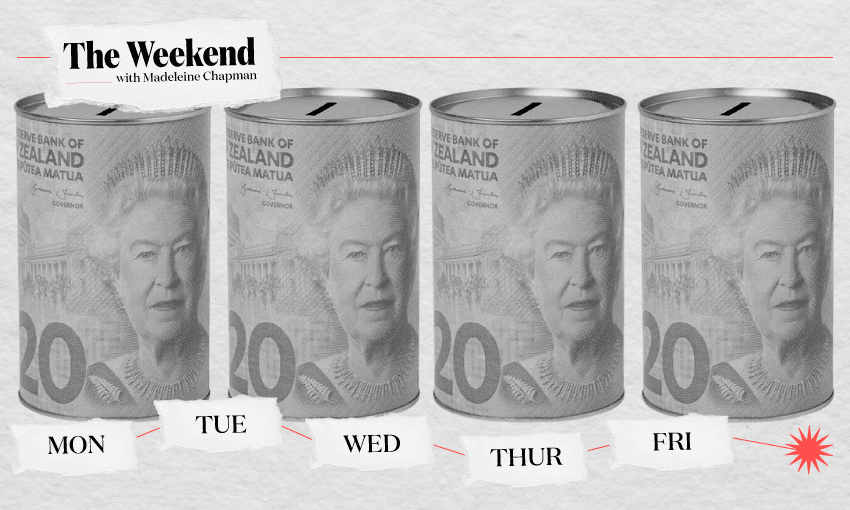

Did anyone else grow up terrified of investing? In my house, money was saved by either putting cash into a piggy bank (risky given the dairy was just down the road), or walking your cash down to the bank and depositing it into your simple saver account.

And money was invested by buying a house. I have vivid memories of my mum telling me as a teenager that I needed to save for a house deposit. Back then a house deposit was closer to $30,000 but as a 15-year-old making $120 a week cleaning a creche, it was the most depressing plan I’d ever heard.

In reality, I have always been an excellent cash saver. From my very first job at 12 years old until I started this job, I saved on average half of all my income. But I did it in the least effective way. Here are some examples:

- When I was a university student I worked almost exclusively cash jobs through student job search. I saved that cash by putting it in a money tin (with no opening) that sat on my dresser. When I graduated and opened it with a knife, there was $12,600 inside. I’m extremely lucky our house wasn’t burgled in that time.

- While overseas after university I left that $12,000 in a bonus saver account, untouched, for nine months. When I got back it was still exactly $12,000 because I forgot I had to make a monthly deposit to earn any interest.

- When I got my first fulltime job, I set my KiwiSaver contribution to 10% but only learned years later that I was with a bank notorious for terrible returns.

- Even as a fulltime worker, I found more satisfaction saving in cash so I bought a giant (like, a metre tall) Coke bottle money bank and began saving. Sometimes I would even withdraw cash in coins in order to put it in the bottle. I saved $6,000 this way and again, was very lucky not to have been burgled in that time.

- The whole time, I did not look into alternative KiwiSaver providers or bank accounts.

None of this is really that bad considering I was able to live my life and save money, which is more than so many New Zealanders are able to do. But there is a real knowledge gap when it comes to building savings. Saving cash is a good thing, but will never be more than what you earn with your labour. And as I now know, that is an endless cycle, not one that you can climb out of with a bit of hard work and determination.

In January I finally learned how straightforward term deposits are. Last year I plucked up the courage to open an investing account with a popular investment platform. With self-employment in my future and the government KiwiSaver contribution halved, I’ll likely prioritise my own investing over the government-endorsed one. At the very least, it’s nice to (finally) know I have many savings options outside of stuffing cash into a tin. Sometimes, when I feel like feeling bad, I calculate what my portfolio would look like if I had known about investing 10 years ago.

I grew up thinking saving money was simply a matter of not spending it. Only recently have I learned how active it should be, and also how many people continue to view saving as putting money in a tin.

When I was leaving university, I spoke to a fellow student who was born into generational wealth. I joked that we were in the same position because neither of us had to pay for our studies (my fees were covered by a scholarship and his were paid for by his parents). He laughed then said actually we weren’t. His parents transferred him his fees every semester, but rather than pay them upfront, he got a student loan (zero interest) and invested his parents’ money, which was now quite a bit more cash than his student loan was.

I just stared at him, baffled. He was confused.

“I thought everybody knew to do that.”

The stories Spinoff readers spent the most time with this week

- The cable that links New Zealand’s islands together electrically is due for replacement, with that will come a huge shift, reports Shanti Mathias

- Winston Peters is right about parliament’s declining standards. Hayden Donnell has noticed one MP in particular has been at the heart it, and his name rhymes with Shminston Smeeters

- Alex Casey analyses the trailer for Prime Minister, the Jacinda Ardern-approved documentary

- Joel MacManus and Lyric Waiwiri-Smith braved the exam-like media lockup to bring you the budget’s contents and a snack review

- We asked a smorgasbord of experts for their thoughts on the budget – here’s what they reckon

Feedback of the week

“Egg in any sandwich is hateful. But egg in a sandwich with lettuce is on a whole different level. Sums up the budget and coalition pretty well though… ‘austerity sandwiches will continue until morale improves’.”

“You eloquently expressed in long form what I have been yelling at the telly for weeks. Thank you.”