Economists saw it coming, banks moved early, and mortgage holders will feel the effects – but the OCR cut heralds only a housing bump at best, writes Catherine McGregor in today’s extract from The Bulletin.

To receive The Bulletin in full each weekday, sign up here.

Called it

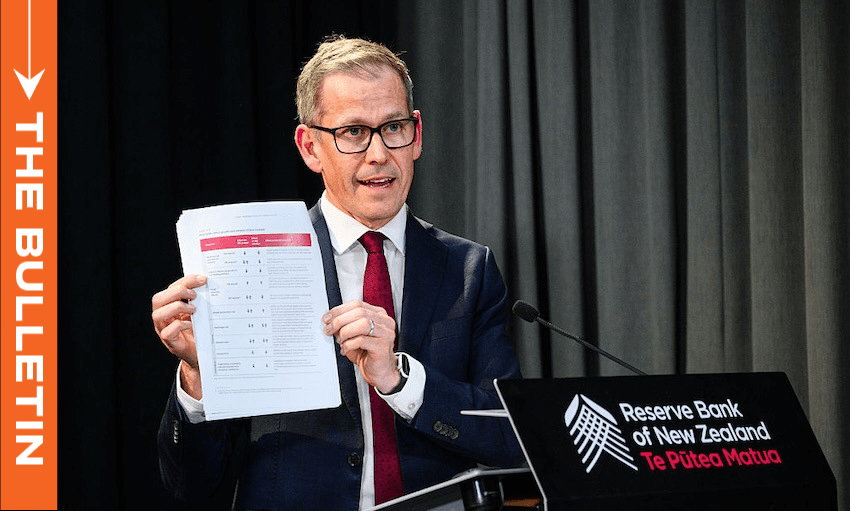

In a move that surprised no one but still carried significant implications, the Reserve Bank yesterday cut the Official Cash Rate (OCR) by 25 basis points to 3.25% – exactly what economists had widely predicted. The central bank’s monetary policy statement (MPS) struck a delicate balance: acknowledging economic recovery while noting persistent global uncertainties, especially from heightened US tariffs. Inflation is now within the 1-3% target band, and core price pressures continue to ease. Though one monetary policy committee member argued for holding the rate at 3.5% while the impact of Trump’s tariffs filtered through, five others voted to cut, citing “significant spare capacity” in the economy. The OCR is now at its lowest point since October 2022, marking a 225-point drop in nine months.

The RBNZ forecasts the OCR at 2.85% by the end of the year, implying at least one more cut, possibly two, before the year’s end, writes the Herald’s Liam Dann (paywalled). “Yet, countering that, Hawkesby said the committee currently had no clear bias as to what its next move will be in July. As the RBNZ has stressed many times in the past, these rate tracks are not forecasts it expects people should count on.” The MPS contained the word “uncertain” a whopping 164 times, Dann’s colleague Jenée Tibshraeny reports (paywalled).

Banks move fast, and mortgage relief is coming

Some banks didn’t wait for the official announcement. BNZ dropped mortgage rates on Tuesday, with Westpac, ANZ and ASB following soon after. Advertised special rates – for those with a below 80% LVR – are currently sitting between 4.95% and 4.99% for one and two-year terms, and 5.39-5.49% for six months.

These shifts matter: nearly half of all mortgages are due to be refixed in the June and September quarters, according to the MPS. That means hundreds of thousands of households will soon find themselves with more discretionary income – a boost not only for household budgets but also, potentially, for the wider economy. Finance minister Nicola Willis hailed the cut as good news for “local shops, local cafes” and hopeful first-home buyers alike.

Buyers return, but don’t expect fireworks

Predictably, real estate agents were quick to herald the cut as the signal buyers had been waiting for. LJ Hooker’s Campbell Dunoon told The Post (paywalled) it could “bolster buyer sentiment”, while Ray White economist Nerida Conisbee suggested lower borrowing costs would prompt renewed activity, especially for first-home buyers.

But independent economist Tony Alexander remains unconvinced. His latest surveys show weak buyer urgency and ongoing sluggishness in auction attendance. “It’s still a buyer’s market,” he writes in OneRoof, adding that while the OCR cut will help some buyers financially, its psychological effect is limited. “For now, the housing outlook remains one of high supply of new and existing properties and buyers feeling no need at all to hurry and make a purchase.”

Kelvin Davidson of Cotality (formerly CoreLogic) struck a similar note, forecasting only a “subdued upturn” in 2025. While the Reserve Bank expects home values to climb 3.5% this year and 4.8% in 2026, the housing rebound, if it arrives, will be modest. With high listings and little FOMO in sight, most experts expect vendors will need to blink first.

Landlords squeezed by poor returns

For residential property investors, the pain isn’t over. Even before this week’s cut, data shows only marginal improvements in yields and cash flow, Greg Ninness of Interest reports. National rental yields have ticked up slightly this year thanks to falling property prices and modest rent increases, but they’re still far from compelling. Once costs like rates, insurance and maintenance are factored in, many investment properties continue to run at a loss. That’s left landlords caught between “the rock of negative cash flow and the hard place of capital losses” if they were to sell, Ninness writes.

Alexander adds that tenants in strong financial positions are staying put – they’re getting good rental deals and see no urgency to buy. That’s understandable, he says, but “with few other buyers competing to acquire property currently, this remains a very good time to make a purchase” – if you’re confident you’ll still have a job in a year’s time, of course.

More reading from The Spinoff:

- Gabi Lardies: Can there ever be a renter’s market in a landlord’s world?

- Hayden Donnell: Disaster: Houses becoming more affordable in Auckland